Mass fiscal austerity is a dead-end street

A sense of crisis fatigue, especially austerity fatigue, has spread throughout the European economy over the last several months. Nobody any more understands the justification for the increased fiscal tightening which is overwhelming those counties suffering from a lack of growth. Everywhere people are concerned that the combination of a strong currency and fiscal austerity risks intensifying inequalities and destroying jobs. In some countries of Southern Europe, millions of young people are experiencing a wave of poverty inherited from the 1930s. Even the political leaders are worried: the President of the European Parliament spoke of the "lamentable" state of the European Union while the Italian Prime Minister said austerity could be the death of his country.

In truth, Europe faces a dual crisis which requires analysis from a political perspective.

First, the economic crisis is causing internal demand to contract. Initially the Commission thought it could deny the extent of the economic contraction by imposing restrictive fiscal policies, i.e. forcing nations to eliminate their public finance deficits. This approach flew in the face of common sense. Cutting down on excessive public spending, making labour more flexible and adjusting public finances for an ageing population are of course necessary. We must also acknowledge the demise of the welfare state, which has come to grief under a tidal wave of public debt. But a sharp contraction in public spending right in the middle of an economic depression is contrary to all rational financial theory. Despite being flattered by the continued equalising effect of the euro, this approach is deemed a failure today. This was expected and was therefore predictable: one after another, the euro zone countries are postponing any return to a balanced budget.

Secondly, the euro crisis revealed a growing differentiation between the countries which adopted the single currency. The euro was supposed to promote harmony between nations. But the opposite can be observed. The currency now crystallises economic and social resentments. The deterioration in Franco-German relations is in this respect instructive. These two countries are the glue which binds the monetary union. Yet characteristic age-old divergences are resurfacing with a vengeance. The currency that unites them has become a cause of profound political irritation.

During the single currency's first seven years, Europe lived under the illusion of easy borrowing at interest rates like those in Germany, whose credit rating the weaker countries appropriated for themselves. When the crisis broke, austerity was advocated to make those countries toe the line in the name of monetary cohesion. Statements by European leaders give the impression of a lack of direction. With so much hesitancy, the European monetary roadmap becomes hard to read. Should fiscal discipline be relaxed as the majority of leaders want or, on the other hand, should interest rates be hiked as called for by the German Chancellor. No consensus exists.

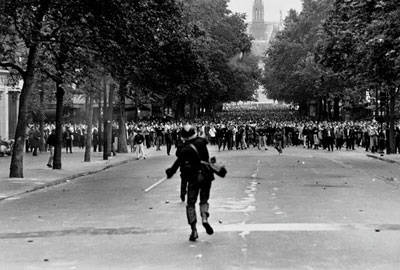

Previously, countries falling behind could devalue their currency to stimulate exports at the price of imported inflation. Devaluation was a way of realigning a currency with its weakened economy. Despite the drawbacks, the economic adjustments which devaluation imposed gave hope for a solution. Today, the weapon of devaluation is no longer available. Only internal devaluation is possible, i.e. a reduction in internal consumption to increase external competitiveness. Short term, this policy leads to increased unemployment and to inequalities that can spill over into social turmoil.

Without wishing to be a doom monger, I believe the future of the single currency is endangered by the crisis and by the lack of a consensus among governments on what economic measures to take. A return to monetary policy basics is also needed, i.e. a policy for managing the currency. Monetary symbolism cannot make the "real" economy function in a disciplined way unless there is political backing and popular support.

The need to manage a currency politically is justified by an indisputable observation: austerity escalates monetary risk by further strengthening the euro and making it ill suited for the countries of southern Europe. The dilemma is here. Europe is striving to reduce public debt through austerity to avoid the ECB refinancing sovereign debt. Austerity, however, increases indebtedness and destabilises the currency.

The European Central bank (ECB) cannot of course become a discount window for the entire public debt of the countries in difficulty. Fiscal and monetary policy should nevertheless be treated in combination, i.e. attributing a political role to the ECB. The body should ideally reflect the democratic representation of the European Parliament. In periods of profound crisis, it is difficult to accept that a central bank, which prides itself on its absolute authority, merely subordinates its currency to an inflation target and ignores economic growth. The ECB is consequently unable to act as an alternative political power, as that would breach its mandate and exacerbate social demands.

To save the euro, money supply must be increased or, put simply, money printing on a reasonable scale is needed at the risk of encouraging various asset bubbles. I am still convinced that the relative value of public debt will be reduced by inflation. This is not apparent yet as money creation is feeding through into the real economy with difficulty given sluggish bank funding channels. But there is no longer any doubt that the time will come when new money creation dilutes public debt. Moreover, the latest ECB report expresses concern over the lack of inflation.

To conclude, two risks seem underestimated in my view. The first is monetary. The single currency was adopted without prior preparation of the euro zone to become an efficient currency area characterised by a reduced role for governments, by fiscal and budgetary harmonisation and by labour force mobility. In other words, the single currency was more a political construct than a monetary reality. The question now is whether the currency as such will be sufficient to withstand the absence of the economic foundations essential to its existence. If not, the breakup of the euro zone or at least an increase in money supply by the ECB to get the economy on the move through inflation will have to be envisaged.

The second risk is social and therefore political in nature. The euro no longer has any unifying power in society. It is even a source of profound social resentment in the countries of the South. In the past, social risk was mitigated by monetary policy decisions and the discipline of devaluation. These tools are no longer available to us today. The rigid nature of the currency forces us to accept that other parameters become changeable. It is therefore theoretically possible for the euro to become a force of social instability if there is no scope for monetary adjustment. In other words, political nationalism could replace nationalism that was only monetary before. This would represent a serious setback, as no one knows how the adjustments in society would occur.

That is why at some point budgetary and monetary constraints will have to be relaxed before Europe collapses under the weight of austerity. Nobel Prize laureate Joseph Stiglitz equates austerity with economic suicide. Is that true? Only the future will tell. But it cannot be ruled out. My intuition tells me that those advocating inflexible budgetary strictness to escape from recession are seriously mistaken. They are committing an historic mistake and an error of judgment.

When public debt climbs to levels that can no longer be eroded by economic growth, a currency can only be stabilised by the controlled reduction of its value i.e. via inflation. An error of judgment by the champions of stubborn fiscal inflexibility carries the risk of social order being disturbed at some point followed by political disruption.